Specialist Credit History Counselling Providers to Overview You In The Direction Of Financial Security

In such situations, looking for the guidance of specialist debt counseling solutions can provide an organized method in the direction of accomplishing financial stability. By recognizing the advantages of enlisting the assistance of a credit scores therapist, individuals can take aggressive steps in the direction of securing an extra stable economic future.

Advantages of Professional Debt Therapy

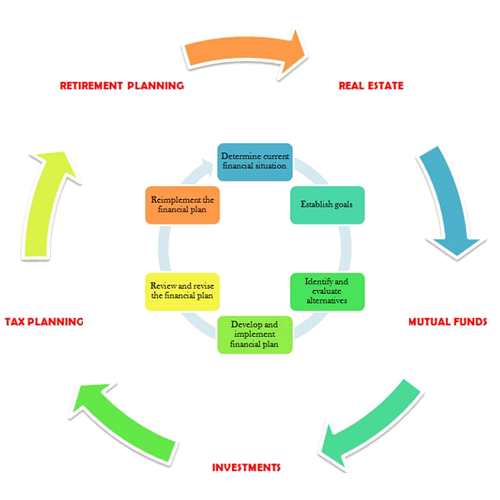

Specialist credit scores counseling solutions supply people useful monetary assistance and techniques to aid them achieve lasting security and financial obligation monitoring. One of the vital benefits of specialist credit scores therapy is the tailored financial strategy that these services give. Credit report counselors work carefully with customers to analyze their financial scenario, produce a practical spending plan, and develop a customized method to pay off financial obligations. This personalized method aids clients obtain a clear understanding of their financial standing and equips them to make educated decisions to boost it.

In addition, specialist credit scores counseling solutions usually bargain with financial institutions in behalf of customers to reduced rates of interest, waive charges, or produce more manageable repayment strategies. This can dramatically reduce the general amount of financial obligation owed and make it simpler for individuals to become debt-free. In addition, credit score therapists use useful monetary education and learning, training customers regarding budgeting, saving, and responsible credit score card usage to avoid future monetary challenges. By outfitting people with the knowledge and devices to handle their finances properly, expert credit counseling services lead the way for lasting financial stability and success.

Steps to Discovering the Right Therapist

Finding the right credit therapist starts with evaluating your monetary objectives and needs. Begin by assessing your existing financial situation, including your debts, earnings, and costs. Comprehending what you really hope to accomplish via credit report counseling will certainly aid you limit your search for the most suitable counselor.

Study various credit history therapy agencies and therapists to locate one that aligns with your financial purposes. Try to find reliable organizations that have licensed and experienced counselors who can supply the support you require. If the firm is approved by a recognized organization and inquire concerning the solutions they use., examine - contact us now.

As soon as you have actually shortlisted prospective counselors, routine appointments to review your monetary challenges and goals. Utilize this opportunity to assess their expertise, interaction style, and proposed strategies for boosting your economic scenario. Do not hesitate to inquire about their charges, the period of the counseling sessions, and what you can anticipate from the procedure.

Comprehending Financial Obligation Administration Program

When checking out financial obligation administration plans, people look for structured strategies for efficiently managing and lowering their arrearages. Financial debt administration plans (DMPs) are contracts in between a debtor and their financial institutions that outline a settlement prepare for the financial debts owed. These plans are generally facilitated by debt coaching agencies to assist individuals better handle their finances and work in the direction of becoming debt-free.

In a DMP, the debt counsellor discusses with the creditors on behalf of the debtor to possibly lower rates of interest, forgo costs, or extend repayment terms to make the debt much more workable. contact us now. As soon as an agreement is reached, the debtor makes monthly repayments to the credit report coaching agency, which after that disperses the funds to the creditors as per the agreed-upon plan

It's crucial for individuals thinking about a DMP to recognize the effects it might have on their credit history and general monetary health and wellness. While registering in a DMP can at first have an unfavorable effect on credit score, effectively finishing the plan can demonstrate monetary obligation and bring about boosted credit reliability over time.

Relevance of Financial Education

Exploring financial obligation administration strategies through the original source debt counselling services highlights the crucial relevance of financial education and learning in equipping people to make informed decisions concerning their financial matters. contact us now. Financial education acts as the foundation for individuals to establish the necessary skills and expertise to effectively manage their finances, stay clear of debt traps, and strategy for a safe monetary future

By recognizing key monetary principles such as budgeting, saving, spending, and credit history monitoring, individuals can navigate the complexities of the economic globe with confidence. Financial education gears up individuals with the tools to examine their monetary situation properly, set sensible economic objectives, and design approaches to achieve them. In addition, it helps people understand the effects of their financial decisions, enabling them to make sound choices that like this align with their long-lasting financial objectives.

Incorporating financial education and learning right into credit counselling services not just aids people in fixing their present monetary difficulties but also equips them with the expertise and abilities required to construct a solid monetary foundation for a thriving and stable future.

Tips for Maintaining Financial Security

Establishing a strong economic regimen is crucial to keeping stability and security in your monetary affairs. Tracking your costs behaviors and determining locations where you can reduce back will aid you stay within your monetary methods.

An additional crucial suggestion for keeping economic stability is to stay clear of unneeded financial obligation. Limitation using bank card and pay off any exceptional equilibriums completely each month to stay clear of accumulating rate of interest fees. In addition, frequently reviewing your monetary goals and changing your budget plan as required can aid you stay on track in the direction of achieving them.

Purchasing your economic education and seeking advice from professional debt counselling services can likewise provide valuable insights and methods for keeping security. By applying these pointers and remaining disciplined in your economic practices, you can function in the direction of a safe monetary future.

Final Thought

Finally, specialist credit history counseling services offer valuable guidance in the direction of attaining economic security. By functioning with a counselor, people can take advantage of individualized advice, debt management strategies, and monetary education and learning to improve their economic circumstance. It is necessary to meticulously pick a therapist who meets your demands and to actively participate in the procedure to keep long-lasting financial stability.

By functioning with a counselor, people can benefit from tailored guidance, debt administration plans, and economic education to enhance their financial situation.